Background:

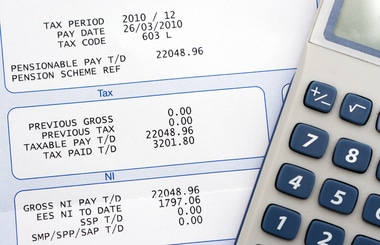

In April of 2020, the Department of Health and Human Services created the Provider Relief Fund in response to the rapid and widespread economic strain caused by COVID-19. Overall, the Provider Relief Fund was distributed to Health Care Providers across the country in 3 large tranches (a fourth tranche was recently opened in September 2021). Any funds received could be applied to any healthcare-related expenses during COVID-19 that were not reimbursed or due to be reimbursed by other sources (ie. SBA PPP Loan). Also, funds could be used toward lost revenues, up to the difference between 2019 and 2020 patient care revenues.

Mark Your Calendars:

Providers who received $10,000 or more from the CARES Act Provider Relief Fund are required to submit their report through the HHS portal by March 31st 2022. The HHS Stimulus (PRF) Reporting Period 2 window opened on January 1st 2022.

If you received PRF funds between 7/1/20-12/31/20, please review the following:

- Reporting requirements for Reporting Period 2 remain the same as Reporting Period 1 – reporting is required for any healthcare provider who received one or more PRF payments of $10,000 or more, in aggregate, during the payment received period.

- No reporting extension is expected for Reporting Period 2 (as was granted for Period 1)

Reminder:

The types of information being requested include comprehensive financial info for the period 1/1/19-6/30/21, PPP Loan applications and allocations claimed on the loan forgiveness forms, statistics by place of service including # of encounters, hospital admissions and ER visits, FTE counts (FT and PT) over 10 quarters (1/1/19-6/30/21), etc.

- For providers who were required to report in Period 1, the Portal will auto-populate previously entered data in certain fields. For RP2, providers will need to show how payments were applied to expenses from Q1 2020 through Q4 of 2021, not to duplicate expenses applied in RP1 report for Q1 2020 through Q2 2021.

- If a practice received $750,000 or more in government funds to include PPP and PRF dollars, the requirements for the single payer independent audit in 2022 remain the same. KatzAbosch is available to perform these audits for practices who meet this criteria.

Phase 3 Reporting Period will open 7/1/2022 – 9/30/2022 for funds received between 1/1/2021 – 6/30/2021.

Please do not hesitate to reach out if you need assistance completing the portal forms. We have prepared and assisted quite a few practices during PRF1 and are familiar with the requirements if you have questions or need assistance completing the forms.

How BlueStone Services Can Help:

BlueStone Services is available to support your medical practice with this matter. We have been monitoring this process closely. We are available to assist you with gathering and submitting your needed information and/or to review your submission prior to formally reporting it.

Contact us today for more information!