Recent Articles

Keep informed on the latest operational news, tips, and best practices. Don't miss out! Sign-up to recieve our monthly newsletter, click here!

10/17/2024

10/17/2024

Best Practices To Improve Your Credentialing Process

Standardization and following best practices during the credentialing process will help ensure that your healthcare organization remains...

Read More 10/03/2024

10/03/2024

Boost Employee Retention With Effective HR Strategies for Long-Term Success

Table of Contents Introduction Understanding Employee Motivation Building a Strong Workplace Culture Offering Growth Opportunities The Role...

Read More 10/03/2024

10/03/2024

Watch Now: CAP Lab Inspection Q&A

Join Karl Wappaus, BlueStone Services’ Client Relationship Manager and Medical Business Advisor Michele Hayward, MHA, MS,...

Read More 09/25/2024

09/25/2024

AI Is Here to Stay: How Should You React?

Artificial intelligence isn’t going anywhere. While that is unsettling for some people to hear, others understand that AI is influencing...

Read More 09/25/2024

09/25/2024

Is This Your Situation: You’re Having Cash Flow Problems

Optimizing your operating cash flow really boils down to three basic rules: Get money you are due as fast as possible. Pay money you owe as...

Read More 09/25/2024

09/25/2024

Attracting and maintaining Gen Z talent

Gen Z is a generation like no other, and in order to maintain your business, you’ll need to think about how you can accommodate the...

Read More 08/27/2024

08/27/2024

Smart Cost-Saving Tactics: Cutting HR Expenses Without Compromising Quality

Table of Contents Introduction Embrace Technology & Automation Streamline Recruitment & Retention for Fewer HR Expenses Remote Work...

Read More 08/26/2024

08/26/2024

10 Essential Questions to Enhance Your Exit Interview Process

Conducting a thorough exit interview is an essential part of the offboarding process. Exit interviews provide a unique opportunity to...

Read More 08/26/2024

08/26/2024

10 Employee Engagement Strategies to Make a Lasting Impact

What does an engaged employee look like? Employee Engagement is a concept that describes the level of enthusiasm and dedication a worker...

Read More 08/22/2024

08/22/2024

Creating an Equitable Compensation Plan

Compensation comprises such elements as wages or salaries, benefits, union perks, employer-provided vendor discounts, work flexibility and...

Read More 08/22/2024

08/22/2024

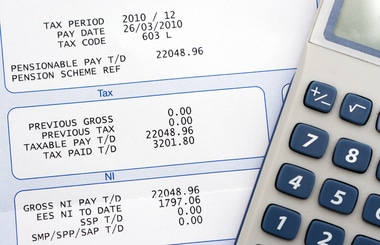

What To Know About Pay Frequency

It’s important for businesses to have a clear and consistent payment schedule to ensure fairness and adherence to labor laws and...

Read More 08/21/2024

08/21/2024

Proposed ban on Noncompete Agreements put on hold

Since the Federal Trade Commission (FTC) proposed banning noncompete agreements in January 2023, followed by its Final Rule approval on...

Read More 08/20/2024

08/20/2024

Minimize Liability Exposure with Expert HR Consulting Services

Table of Contents Introduction The High Price of HR Mistakes HR Consulting: Your Shield Against Risk Areas Where HR Consulting Can Make a...

Read More 08/20/2024

08/20/2024

Reclaim Your Time: Outsourced HR Services Solve Persistent HR Problems

Table of Contents Introduction The Persistent HR Problems That Plague Businesses How Outsourced HR Services Can Rescue Your Business...

Read More 07/30/2024

07/30/2024

What To Know About Business Financial Ratios

How do you measure how robust your business is? One of the key ways is by looking at business financial ratios, which can be grouped into...

Read More 07/29/2024

07/29/2024

What To Know About FSAs For 2024

The IRS has raised the contribution limit of FSAs for 2024 by $150 for these accounts. FSA participants can now contribute up to $3,200...

Read More 07/29/2024

07/29/2024

What To Know About New Employee Onboarding

Do you want to help your new employees have a positive experience, setting them up for long-term success? Employee onboarding is a...

Read More 07/24/2024

07/24/2024

Is it time for an employee engagement satisfaction survey?

How would you define an engaged workforce? You might say it’s an environment where everyone involved feels valued and supported....

Read More 07/24/2024

07/24/2024

Quiet Vacationing: A Question of Company Culture

First quiet quitting, now quiet vacationing. What is going on? This is a good question with complicated answers. Quiet vacationing, also...

Read More 07/17/2024

07/17/2024

Is This Your Situation: Are Financial Forecasts Just the Beginning?

Why isn’t it good enough to simply meet your forecast? Unless your company is doing absolutely everything right and there’s no room...

Read More 07/17/2024

07/17/2024

Choosing A Business Checking Account

Small businesses have different needs than individual investors, and banks have created a wide range of financial services and products to...

Read More 07/12/2024

07/12/2024

Understanding Regulatory Requirements in Human Resources

Table of Contents Introduction Key Areas of HR Regulatory Compliance Hiring and Recruitment Wage and Hour Regulations Benefits...

Read More 07/12/2024

07/12/2024

Start Your New Hires Off Right With a Smooth Onboarding Process

Table of Contents Introduction Pre-Boarding Steps First Day Agenda Training and Development Plan Setting Clear Expectations and Goals...

Read More 07/09/2024

07/09/2024

Advanced Payroll Solutions for Companies Big and Small

Table of Contents Introduction Features of Modern Payroll Solutions Choosing the Right Payroll Provider BlueStone Is Here to Help Key...

Read More 07/09/2024

07/09/2024

Top 11 Tips for Effective Talent Retention

Table of Contents Introduction Tip 1: Offer Competitive Compensation and Benefits Tip 2: Provide Opportunities for Growth and Development...

Read More 07/09/2024

07/09/2024

New Noncompete Agreement Rule May Impact Your Business

Since the Federal Trade Commission ‘s (FTC) January 2023 proposal to ban noncompete agreements, followed by its Final Rule approval on...

Read More 07/09/2024

07/09/2024

The Benefits of Interim Practice Management

The benefits of interim practice management are many. Hiring the wrong person into a senior leadership position is one of the most damaging...

Read More 06/28/2024

06/28/2024

Mastering the Art of Negotiating Payor Contracts in Healthcare

Updated on 6/28/24 In the intricate realm of healthcare, the art of negotiating payor contracts is a skill that can significantly impact...

Read More 06/28/2024

06/28/2024

Bringing on a New Provider? The Importance of Not Waiting For Credentialing

Updated on 6/28/24 What is credentialing? In a healthcare setting, physician credentialing is the formal process of verifying the...

Read More 06/26/2024

06/26/2024

Summer Due Diligence Compliance Checklist

Maintaining and updating your compliance program is an important part of any healthcare organization. Making sure your organization is...

Read More 06/17/2024

06/17/2024

Choosing a Successor: Eight Tips

It’s not easy to decide to step down from your position leading a company. But when the time is right and the decision must be made,...

Read More 06/17/2024

06/17/2024

Breaking Down Employee Breaks

Under the Fair Labor Standards Act, employers generally do not have to provide short breaks or lunch periods to employees. However, the Act...

Read More 06/17/2024

06/17/2024

Getting Offboarding Right

Like other HR branches, offboarding is evolving drastically. Offboarding is no longer about creating a list of administrative tasks and...

Read More 05/24/2024

05/24/2024

What Types of Accounting Services Can You Outsource?

Updated on 5/24/24 Maintain accurate records; keep track of your company’s finances, bookkeeping, payroll, management accounting,...

Read More 05/17/2024

05/17/2024

Is Your HR Department Meeting the PCORI Fees Deadline?

Updated on 5/17/24 The Deadline to Pay PCORI Fees is Monday, July 31, 2024. The Patient-Centered Outcomes Research Institute (PCORI) is an...

Read More 05/17/2024

05/17/2024

Why Your Organization Needs A Dedicated Employee Onboarding Program

Updated on 5/17/24 In today’s fast-paced business world, every organization is constantly searching for ways to increase efficiency...

Read More 05/14/2024

05/14/2024

Maryland Adopts Pay Transparency Requirements

Maryland has become the latest in a growing list of states to adopt pay transparency requirements, with our governor recently signing the...

Read More 05/14/2024

05/14/2024

New Timeline for Maryland’s Forthcoming Paid Leave Program

The Maryland General Assembly recently passed a bill making some changes to the Time to Care Act (the law that set the stage for...

Read More 05/10/2024

05/10/2024

Top 5 Tips for Hiring Managers

While the landscape for businesses looks a little wobbly lately, with a post-COVID recession looming and an uncertain stock market, one...

Read More 05/01/2024

05/01/2024

Alternative Business Structures That Might Be Right for Your Company

Since the start of the COVID-19 pandemic, many aspects of business have changed, including (in some sectors) the increasing availability of...

Read More 05/01/2024

05/01/2024

Is an ESOP the Right Choice for Your Company?

Employee stock ownership plans have been in the headlines recently, but they have been around for decades. ESOPs are qualified defined...

Read More 05/01/2024

05/01/2024

Monitoring Your Employees’ Productivity

Worker productivity has been in the headlines recently. One reason is the easy access employers have to the many technologies that can...

Read More 04/26/2024

04/26/2024

Outsourced Accounting and Due Diligence

Due diligence is a deep-dive investigation relating to compliance. It can be an essential function to help you understand your potential...

Read More 04/26/2024

04/26/2024

How HR Should Handle Employee Leave of Absence Requests

Employees have always enthusiastically embraced generous leave policies. Surveys have found that many respondents even prefer additional...

Read More 04/16/2024

04/16/2024

Top HR Cybersecurity Threats and Tips For Prevention

More and more employers are automating their human resources processes. Many also integrate their HR processes with interrelated...

Read More 04/16/2024

04/16/2024

How To Improve and Streamline HR Processes: A Detailed Guide

Human resources serves as the backbone of any organization, responsible for everything from talent acquisition to employee well-being....

Read More 04/02/2024

04/02/2024

Is This Your Situation: You Need To Get Information From Your Financials

If you don’t understand your financials, you are impeding your ability to grow and prosper. What should you learn about your...

Read More 04/01/2024

04/01/2024

What Is Fractional HR? An In-Depth Look

Fractional HR services are a modern approach to human capital that allows companies to leverage HR expertise on a part-time basis,...

Read More 03/06/2024

03/06/2024

Intro to Business Tax Deductions

To be deductible, a business expense must be both ordinary — common and accepted in your industry — and necessary, helpful and...

Read More 03/03/2024

03/03/2024

What Will Employee Retention Look Like in the Post-Pandemic Workplace?

Who could have predicted the disruption and change 2020 brought to the way we work? Now that we are starting to look ahead, past the loss...

Read More 02/26/2024

02/26/2024

The Role of an HR Consultant in Developing Effective Management Techniques

Table of Contents Introduction How HR Consultants Identify Pain Points How HR Consultants Cultivate Strong Pipelines How HR Consultants...

Read More 02/23/2024

02/23/2024

Four Considerations For Small Business HR Growth

The consensus among HR leaders is that once you’ve reached the 20-employee mark, it is definitely time to hire a dedicated HR...

Read More 02/23/2024

02/23/2024

3 Signs You Have Outgrown Your Employee Management Solution

Employee management software is pivotal to the success and overall flow of workforce management. At the very least, the employee management...

Read More 02/19/2024

02/19/2024

Why Do Small Businesses Hire Firms to Provide HR Advisory Services?

The foundation of any good company, whether a big multinational corporation or a small business, is only as strong as the people who work...

Read More 02/19/2024

02/19/2024

HR Compliance Audit – What to Know, Where to Start

If you’re responsible for human resources in your company, then you know that staying compliant with state and federal laws is a...

Read More 02/19/2024

02/19/2024

How To Achieve Excellence in HR Service Delivery

The human resource function is responsible for providing services as well as support to employees during their time working for a company,...

Read More 02/16/2024

02/16/2024

Top 8 Reasons For Why You Should Use Outsourced Accounting Services

Outsourced accounting services are not the right fit for everybody, but it might be a perfect fit for you. Even so, you may be wondering...

Read More 02/09/2024

02/09/2024

Why a Good Employee Handbook Is Important (and Often Overlooked)

Table of Contents Introduction What is an Employee Handbook? Key Components of an Effective Employee Handbook Benefits of Having a...

Read More 02/08/2024

02/08/2024

Essential HR Compliance Checklists For Employee Management, Benefits, And Payroll Processing

Human resources, employee benefits and payroll processing functions are separate yet intertwined, and HR compliance checklists are...

Read More 02/07/2024

02/07/2024

Choosing a Business Structure: C Corps, LLCs, PCs and S Corp

How to structure your business is one of the first, and most important, considerations a business must make. Following are details about...

Read More 02/07/2024

02/07/2024

New Independent Contractor Rules: Do They Affect Your Employees?

The Department of Labor’s final rule for employee or independent contractor classification under the Fair Labor Standards Act...

Read More 02/07/2024

02/07/2024

Think Your Business Doesn’t Need an Employee Handbook? Think Again!

The employee handbook is no longer viewed as just a communication tool for employers. It’s now regarded as a protection strategy as...

Read More 02/05/2024

02/05/2024

How To Hire An HR Consultant: What To Consider Before Hiring An HR Consulting Firm

If you’re like most business owners, you don’t have a lot of time to spare. That’s why it’s important to do your research before...

Read More 02/02/2024

02/02/2024

HR Compliance Checklist for a Successful Human Resources Audit

When it comes to HR compliance, businesses must take an active approach to ensure they meet all necessary regulations and requirements....

Read More 01/23/2024

01/23/2024

Decoding Employee Engagement: Comprehensive Methods of Measurement

Table of Contents Introduction Why Measure Employee Engagement? Traditional Methods of Measuring Engagement Digital Approaches to...

Read More 01/08/2024

01/08/2024

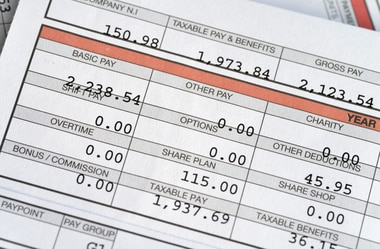

Payroll Tax Rates and Contribution Limits for 2024

Understanding payroll tax rates and contribution limits is crucial for both employees and employers as it directly impacts financial...

Read More 01/08/2024

01/08/2024

The Importance of Confidentiality in HR

Human resource professionals are held to the highest standards when it comes to confidentiality. To see why, you only need to look at the...

Read More 01/08/2024

01/08/2024

Employee Engagement by the Numbers: Unveiling Critical Statistics

Table of Contents Introduction The Importance of Employee Engagement Statistics Global Engagement Trends Engagement Rates by Industry...

Read More 01/08/2024

01/08/2024

The 1099 Story: Which Version Should You Be Using?

As each calendar year draws to a close, many businesses have to think about their tax filing responsibilities. It can be confusing to...

Read More 12/06/2023

12/06/2023

Form I-9 Basics

Form I-9 has been modernized, allowing E-Verify employers to remotely examine I-9 documents. All U.S. employers must complete Form I-9 for...

Read More 12/05/2023

12/05/2023

Artificial Intelligence Enters the Tax Realm

Artificial intelligence offers a range of services to leverage for clients. Automation of mundane tasks and generation of insights and...

Read More 12/05/2023

12/05/2023

Avoid Incomplete or Disorganized Records

Every employer covered by the Fair Labor Standards Act must keep records for each covered nonexempt worker. There’s no required form,...

Read More 11/07/2023

11/07/2023

Is This Your Situation: Figuring Out What Expenses You Can Deduct?

“You can deduct that — it’s a business expense” is often casually tossed around, as if it gives business managers carte...

Read More 11/07/2023

11/07/2023

More Will Have to E-File in New Year

New rules, issued in early 2023, change a wide range of filing requirements. The goal, according to the IRS, is to increase e-filing...

Read More 10/10/2023

10/10/2023

80 Innovative Employee Engagement Strategies To Boost And Empower Your Team

Employee engagement is more than just a buzzword; it’s a critical factor that can make or break a company’s success. High...

Read More 10/10/2023

10/10/2023

How To Create a Raise Policy

In most cases, employees anticipate receiving a raise after working a certain amount of time at your firm — usually, six months to a...

Read More 10/05/2023

10/05/2023

Don’t Just Check the Box on Annual Performance Reviews

Performance management is a holistic approach that assists organizations in accomplishing their goals and objectives by continuously...

Read More 09/19/2023

09/19/2023

Is This Your Situation: You Need To Get Information From Your Financials

If you don’t understand your financials, you are impeding your ability to grow and prosper. What should you learn about your...

Read More 09/14/2023

09/14/2023

The Problems with Incomplete and Disorganized Records

An unorganized and inefficient payroll process is a recipe for eventual disaster. If you rely on paper processes, both manual data entries...

Read More 08/22/2023

08/22/2023

Is the Hybrid Work Schedule Here To Stay?

The hybrid experiment has gained traction. By 2023, Gallup research indicated the numbers among U.S. workers had stabilized at about 28%...

Read More 08/22/2023

08/22/2023

New 1099 Portal Helps with Upcoming Paper Filing Restrictions

The IRS has announced that starting in 2024, it is going to “reduce the 250-return threshold enacted in prior regulations to...

Read More 08/21/2023

08/21/2023

Learn The Rules About Disability Discrimination

The Americans with Disabilities Act defends the rights of people with disabilities in the context of employment. Title I of the ADA...

Read More 08/21/2023

08/21/2023

Gifts for Employees: The Thought That Counts

Managers reap benefits from giving presents to their teams: Recipients may feel a morale boost and increased motivation to improve...

Read More 07/17/2023

07/17/2023

Business Succession in the Post-COVID-19 World

This is not the first or last time you will hear this: COVID-19 changed everything. But it has had a specific impact on business owners who...

Read More 07/17/2023

07/17/2023

What is keeping CFOs up at night?

Today’s CFOs face many concerns, which can be reduced to three overarching issues: The uncertain state of the economy, which is...

Read More 07/12/2023

07/12/2023

Why You Should Prioritize Succession Planning

What is succession planning? Succession planning is the process of identifying and developing employees to fill key leadership positions...

Read More 06/13/2023

06/13/2023

Watch Out for Fake ERC Plans

ou may be aware of widely circulated promotions — ads on radio and the internet — touting refunds involving Employee Retention Credits....

Read More 06/12/2023

06/12/2023

The IRS Is Pushing Its ID.me Accounts

What is ID.me? ID.me simplifies how individuals prove and share their identities online. The idea is that you’ll have to verify your...

Read More 06/12/2023

06/12/2023

Hiring Temporary Help at the Office

Approximately 3 million temporary and contract workers are hired each year in the U.S., and managers have long relied on temps to keep...

Read More 06/08/2023

06/08/2023

Cannabis in the Workplace – How to Manage Maryland’s New Cannabis Laws

Cannabis in the Workplace – How to Manage Maryland’s New Cannabis Laws Beginning on July 1, 2023, Maryland will legalize the...

Read More 05/15/2023

05/15/2023

Why It’s Important to Prioritize Psychological Safety in the Workplace

Psychological safety is the belief that you can share your thoughts, opinions, mistakes, and ideas without fear of negative consequences....

Read More 05/04/2023

05/04/2023

401(k) Plan Self-Audit: Do Not Overlook These 6 Areas

Under IRS and Department of Labor rules, employers whose 401(k) plans have over 120 eligible participants on the first day of the plan year...

Read More 05/02/2023

05/02/2023

How and When To File Prescription Drug Data Collection (RxDC) Data

Section 204 of the Consolidated Appropriations Act, 2021 requires insurance companies and employer-based health plans to report on...

Read More 04/26/2023

04/26/2023

COVID19 PHE Ending May 11th 2023: Helpful Tips for Medical Practices to Manage the Transition

As HHS Secretary Xavier Becerra announced in the letter to U.S. Governors, the COVID-19 PHE expired at the end of May 11, 2023. Department...

Read More 04/24/2023

04/24/2023

Covid National Emergency Ending May 11th: What HR Compliance Needs To Change and How Can An HR Consulting Solution Help

On Jan. 30, 2023, the Biden Administration announced the COVID-19 national emergency and public health emergency declarations were ending...

Read More 03/30/2023

03/30/2023

Payroll Tax Rates and Contribution Limits for 2023

Below are federal payroll tax rates and benefits contribution limits for 2023. Social Security tax In 2023, the Social Security tax rate...

Read More 03/29/2023

03/29/2023

How to Organize a Retirement Party

Whether you are planning a retirement party for a coworker, a departing boss or even yourself, the most important rule is that it should be...

Read More 03/29/2023

03/29/2023

HUBZone Program: Still Available, Changes Coming

According to the SBA, the HUBZone program fuels small business growth in historically underutilized business zones. The idea is to award at...

Read More 03/20/2023

03/20/2023

5 Tips To Successfully Transition to A Manager Role

Moving from an individual contributor to a manager is a common career progression for many professionals. While it is an exciting...

Read More 03/14/2023

03/14/2023

Will My Noncompete Agreement Hold Water?

You may want to require employees to sign noncompete agreements to keep them from working for rival companies. Will these protect the...

Read More 03/14/2023

03/14/2023

Know the Rules on Business Travel

Are you working on this year’s tax return or planning for the future? Either way, you should know the rules on business travel tax...

Read More 03/09/2023

03/09/2023

New IRS Portal for Form 1099 Series

The IRS has announced that businesses can now file Form 1099 series information returns using a new online portal, available free from the...

Read More 03/09/2023

03/09/2023

Three Ways Employers Can Support Employee Wellness to Drive Retention

Employee wellness has become an increasingly important topic in the workplace, and for good reason. Not only is it important for the health...

Read More 02/20/2023

02/20/2023

Three Considerations When Setting Pay

Your starting salaries should be competitive, fair and aligned with your budget. Many factors come into play when striking this balance,...

Read More 02/20/2023

02/20/2023

Cash Flow Statements: The Key to Business Success

In the complex world of business operations, leaders often find themselves navigating a sea of financial statements and documents. While...

Read More 02/15/2023

02/15/2023

Business Owners May Face Special Compensation Rules

S corporations allow the business to pass corporate income, losses, deductions and credits through to their shareholders for federal tax...

Read More 02/15/2023

02/15/2023

5 Must Haves for Employee Recognition Programs that Work

According to a recent Gallup survey, it has been shown that approximately “36% of U.S. employees are engaged in their work and...

Read More 01/17/2023

01/17/2023

IRS Establishes Mileage Rates for 2023

The IRS has issued the 2023 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business,...

Read More 01/17/2023

01/17/2023

New Law Ushers in Major Retirement Changes

There’s been buzz about new retirement plan provisions for weeks, and now they’re final, bringing about changes to various...

Read More 01/12/2023

01/12/2023

Should You Reimburse Employees For Home Office Expenses?

What challenges have your employees been facing, and how can you offer the solutions they need? Deciding on a home office reimbursement...

Read More 12/05/2022

12/05/2022

How Do Taxes Work With Bonuses?

Bonuses, frequently given at the end of the year, are a popular “thank you” for a job well done, and smart business owners know...

Read More 12/05/2022

12/05/2022

Staying Current on Labor Rules

Hiring staff? Good for you! It means your business is thriving. Now is the time to get up to speed or reacquaint yourself with any labor...

Read More 11/15/2022

11/15/2022

Understanding the Maryland Saves Program: A Small Business Owner’s Guide

Table of Contents: Introduction The Maryland Saves Program: An Overview Why Choose the Maryland Saves Retirement Program? Who Is Eligible...

Read More 11/01/2022

11/01/2022

What To Know About Fringe Benefits and Taxes

You can generally deduct the amount you pay your employees for the services they perform. The pay may be in cash, property or services. It...

Read More 11/01/2022

11/01/2022

Are You Worried About Inflation?

When inflation is at play, the decline of the value of money and the incline in prices is a combination that impacts everyone. Not even...

Read More 09/27/2022

09/27/2022

Tips for Managers: How to Discuss Pay With Your Employees

During the normal course of business, managers are typically required to have conversations with their employees regarding compensation....

Read More 09/27/2022

09/27/2022

Employee Retention Credit: Over but Not Done

The federal government’s Employee Retention Credit proved to be a lifeline for many businesses and their employees. The eligibility...

Read More 09/26/2022

09/26/2022

Are Your Employees Quiet Quitting? What Employers Need To Know

CBS News says, “There’s a new term for clocking in and doing the bare minimum at work: ‘quiet quitting.'” This...

Read More 09/26/2022

09/26/2022

The Affordable Care Act: A Review and Update

As explained on the official government health care site, the law has three goals: Make affordable health insurance available to more...

Read More 09/20/2022

09/20/2022

Fall planning? Remember the Maryland Time to Care Act

Fall planning is upon us and we want to make sure in addition to your thoughts around annual business strategies you are including the new...

Read More 07/29/2022

07/29/2022

Lease Accounting – Should You Lease or Buy?

When it comes to lease or buy, there are pros and cons to both options. In this post, we will explore the advantages and disadvantages of...

Read More 07/11/2022

07/11/2022

For Retro ERC, Use Form 941-X

Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund, may be your key to getting all the Covid relief...

Read More 07/11/2022

07/11/2022

Take a Look at the Alternative Workforce

One of the most fitting descriptions of the alternative workforce comes from Deloitte. In the company’s words, they have said...

Read More 06/08/2022

06/08/2022

How To Create a Salary Plan

Don’t use guesswork when figuring out how much to pay your employees. You need a comprehensive, long-term plan to figure out a talent...

Read More 06/06/2022

06/06/2022

Identifying Breadcrumbing Signs and Keeping Candidates Engaged: A Guide to Ethical Recruitment

Competing for talent is not easy, especially in a tight labor market. To snag the most qualified candidates, employers must make a good...

Read More 06/06/2022

06/06/2022

The Strategic Role of the CFO

The chief financial officer of a company has always had a seat at the table, but the current business environment combined with changes...

Read More 06/06/2022

06/06/2022

Improve Your Payroll Audits With Automation

Payroll is a core feature of all businesses, and it is very important as it heavily impacts the morale of employees. After all, if...

Read More 05/09/2022

05/09/2022

Integrated Timekeeping: A Strategy for Preventing Payroll Errors

Under the Fair Labor Standards Act, employers are required to maintain updated records of the hours worked by nonexempt employees....

Read More 05/09/2022

05/09/2022

Flexible Work Is Key to Retention

In a flexible work arrangement, employees typically get to choose their work location and their work arrival and departure times. They may...

Read More 05/09/2022

05/09/2022

Qualities of a Good Payroll Technology Demo

A product demonstration or demo enables vendors to present the value of their product or service to prospective buyers. So if you’re...

Read More 04/28/2022

04/28/2022

Maryland Enacts Paid Leave Law – What It Means For You

Last month the Maryland Legislation voted to pass a paid family and medical leave insurance program. Called the Time to Care Act, the new...

Read More 03/29/2022

03/29/2022

How To Choose a Financial Wellness Vendor

In a 2020 survey, 44.9% of respondents said they would view their employers in a better light if they provided a financial wellness...

Read More 03/29/2022

03/29/2022

Is This Your Situation: You Want a Paperless Payroll

Paperless payroll is a paper-free payroll process that has become hugely popular in recent years. But despite the groundswell of support...

Read More 03/29/2022

03/29/2022

How To Hire In A Tough Labor Market

As a manager, you know how to promote your products. In a tough labor market, it may help you to view your job postings in the same way....

Read More 03/18/2022

03/18/2022

COVID-19 Pandemic and Caregiver Discrimination

Discrimination against a person with caregiving responsibilities may be unlawful under federal employment discrimination laws enforced by...

Read More 02/24/2022

02/24/2022

Exempt vs. Nonexempt: Where the Dividing Line Is

Employers covered by the Fair Labor Standards Act are required to pay nonexempt employees for all hours worked. It sounds simple enough,...

Read More 02/08/2022

02/08/2022

7 Considerations When Preparing Your Payroll Budget

Most companies spend 20% to 30% of their annual revenue on payroll. The exact amount varies based on the employer’s size, industry,...

Read More 02/07/2022

02/07/2022

Is This Your Situation: You’re Spending Too Much on Bookkeeping

Wondering what your options are to reduce spending and increase income? Here are some tips: Organizing your finances is the foundation for...

Read More 02/07/2022

02/07/2022

Is This Your Situation: Feeling Overwhelmed by Payroll

Do you ever wish you didn’t have to go through the hassle of preparing a payroll? Maybe it was simple when you just had one or two...

Read More 02/07/2022

02/07/2022

Can You Be Exempt and Nonexempt at the Same Time?

You can allow an employee to work two different jobs for your company. However, under the FLSA, you cannot classify an employee as both...

Read More 02/07/2022

02/07/2022

Unemployment and Tax: Back to Normal

Unemployment income has always been taxable income. Those who apply for unemployment benefits can have federal tax, and any applicable...

Read More 01/17/2022

01/17/2022

Payroll Tax Rates And Contribution Limits For 2022

Below are federal payroll tax rates and benefits contribution limits for 2022. Social Security tax In 2022, the Social Security tax rate...

Read More 01/17/2022

01/17/2022

Is 401(K) Auto Enrollment Right For Your Company?

Traditionally, employees have to opt into retirement plans and make their own decisions about contributions. But there’s another...

Read More 01/17/2022

01/17/2022

How To Retain Employees In A Tough Market

Imagine you’re a nursing home manager trying to replace a nurse’s aide. But the resumes aren’t coming in like they...

Read More 01/17/2022

01/17/2022

IRS Announces Standard Mileage Rates For 2022

The IRS has issued the 2022 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business,...

Read More 01/10/2022

01/10/2022

The HHS Stimulus (PRF) Reporting Period 2 opened – What You Need to Know

Background: In April of 2020, the Department of Health and Human Services created the Provider Relief Fund in response to the rapid and...

Read More 12/02/2021

12/02/2021

IRS Announces 2022 Limits for Retirement Plans

The IRS has announced the new retirement plan numbers for 2022. Retirement limits for 401(k) and similar plans are up. The contribution...

Read More 12/02/2021

12/02/2021

Can You Clearly Explain Your Health Insurance Plan?

According to a report by the International Foundation of Employee Benefit Plans, just 19 percent of employers say their employees had a...

Read More 12/02/2021

12/02/2021

7 Ways To Manage the Worker Shortage

Many businesses are struggling with a worker shortage. It is happening across the board: staff shortages at our doctors’ offices, at...

Read More 12/02/2021

12/02/2021

An FMLA Questionnaire To Keep You Compliant

Employer coverage – Is your business covered by the Family and Medical Leave Act (FMLA)? You must adhere to the FMLA if you employ at...

Read More 11/03/2021

11/03/2021

On-Demand Pay: A Growing Payroll Trend

A 2020 report by Ernst & Young says on-demand pay is “the term used to describe a category of financial products that give...

Read More 11/03/2021

11/03/2021

What Is the Cost of Employee Vacancies?

How much money is lost when you leave a position vacant? There’s a financial impact to keeping a role open. Efficient, productive...

Read More 11/03/2021

11/03/2021

Digital Dexterity: The Goal of a Successful Workplace

The workplace of the future is no longer abstract. It is a reality, but a reality that is different for each business. Every workplace has...

Read More 11/03/2021

11/03/2021

Taxable and Nontaxable Employee Benefits

As the unemployment rate falls from its 2020 high, employees are switching jobs in record numbers. The new stability in the economy means...

Read More 10/14/2021

10/14/2021

Protecting Wealth Through the Use of Family Offices

Family offices act as the heart of a family’s operations, doing everything from managing their financial lives to overseeing their...

Read More 10/13/2021

10/13/2021

The Whys and Hows of Outsourcing Payroll

In Bloomberg Tax & Accounting’s 2019 Payroll Benchmarks Survey, 69.2% of respondents said they used outside vendors to perform...

Read More 10/11/2021

10/11/2021

5 Must-Haves for Any Payroll Solution

Studies show that the vast majority of employers use payroll software, which saves time by automating manual processes and decreasing...

Read More 10/11/2021

10/11/2021

EEOC Provides Updated Guidance on COVID-19 Vaccine Policies

The Equal Employment Opportunity Commission has updated its guidance on workplace COVID-19 vaccine policies. The agency’s original...

Read More 09/14/2021

09/14/2021

Sick and Family Leave Reporting Guidance

The Treasury Department and the IRS have issued Notice 2021-53, which provides guidance to employers about using Form W-2 to report...

Read More 09/14/2021

09/14/2021

How To Handle Your First Payroll

Regardless of whether your first payroll involves a few employees or many, the goal is to execute payroll in an accurate and compliant...

Read More 09/14/2021

09/14/2021

Employee Retention Credit: Further Guidance

In COVID Tax Tip 2021-123, the IRS clarifies some of the confusion surrounding the powerful but complex Employee Retention Credit. The IRS...

Read More 09/14/2021

09/14/2021

Vaccine Mandates: The Elephant in the Room

COVID-19 and its variants continue to disrupt the way we live, work and play. The population disagrees on whether to wear masks or be...

Read More 08/12/2021

08/12/2021

Should Employees Get Paid for Orientation & Training?

It is not uncommon for a new hire to pose the question: Do you get paid for orientation? Orientation formally introduces the new hire to...

Read More 08/12/2021

08/12/2021

Should You Pay an Employee Who Resigns With Two Weeks’ Notice?

An employee who resigns with two weeks’ notice may think they are doing you a favor. But in fact, it can be a payroll headache,...

Read More 08/12/2021

08/12/2021

Why Use Time and Attendance Software?

Documentation is key to wage and hour compliance. Simplify time tracking by automatically calculating hours worked as well as vacation...

Read More 08/12/2021

08/12/2021

What Can a Payroll Service Do for You?

Even if your business has only a few employees, you may be considering outsourcing your payroll processing to a specialist. What can a...

Read More 07/23/2021

07/23/2021

Create a Strategy To Bring Back Workers

“Going back to the office” takes on new meaning after more than a year of working from home. Some people are excited to get...

Read More 07/23/2021

07/23/2021

Health Insurance Alternatives for Small Businesses

Employer-based health insurance costs have increased modestly since 2012 — between 3% and 5% annually for family coverage, according to a...

Read More 07/23/2021

07/23/2021

Executive Order Targets Noncompete Agreements

These days, many employees at companies large and small to sign an agreement when they’re onboarded. It says that they’re not...

Read More 07/23/2021

07/23/2021

What Employers Need to Know About FICA Taxes

The Federal Insurance Contributions Act (FICA) mandates that employers have to withhold, and also match, certain taxes. FICA consists of...

Read More 06/28/2021

06/28/2021

EEOC Publishes Updated COVID Guidance

As workplaces resume in-person operations, or at least consider doing so, there are many questions about the rules and requirements....

Read More 06/28/2021

06/28/2021

Affordable Care Act Upheld — Again

In a 7-2 decision, the U.S. Supreme Court upheld, again, the Affordable Care Act. Texas and other states had sued to overturn it. The...

Read More 06/28/2021

06/28/2021

Retirement Plan Startup Costs Tax Credit

A tax credit for small-employer pension plan startup costs may be awaiting you. You may be able to claim a tax credit of up to $5,000 when...

Read More 06/28/2021

06/28/2021

Planning Ahead for Tax Credits and Deductions

Everybody wants to pay as little in taxes as possible. Most people use software or hire an accountant to help them find all the deductions...

Read More 06/01/2021

06/01/2021

What Is a Money Purchase Pension Plan?

A money purchase pension plan is an employee retirement benefit plan that requires companies to contribute a specific percentage of an...

Read More 06/01/2021

06/01/2021

IRS Adjusts HSA Limits for 2022

As it does each year, the IRS has announced changes for health savings accounts, which are associated with high-deductible health plans....

Read More 06/01/2021

06/01/2021

Do You Need an Economic Injury Disaster Loan?

Even before the pandemic, the Small Business Administration offered Economic Injury Disaster Loans for “losses not covered by...

Read More 06/01/2021

06/01/2021

How Do Holidays Affect FMLA Leave?

The Family and Medical Leave Act (FMLA) dictates that employers with 50 or more employees must give eligible employees up to 12 weeks of...

Read More 04/28/2021

04/28/2021

A Checklist for Navigating Open Enrollment

Before Open Enrollment – Reflect on the previous open enrollment period. Note the successes and failures and formulate a strategy for...

Read More 04/28/2021

04/28/2021

When You Have an HR Department of One

At a minimum, the human resources department handles: Recruiting. Hiring. Compensation. Employee benefits. Training and development....

Read More 04/28/2021

04/28/2021

How Much FMLA Leave Should Part-Time Employees Receive?

To take leave under the Family and Medical Leave Act, an employee must: Work for an employer that has least 50 employees for 20 or more...

Read More 04/28/2021

04/28/2021

Employers Get Tax Breaks for Vaccination Leave

Small and midsize employers, and certain governmental employers, can claim refundable tax credits that reimburse them for the cost of...

Read More 03/22/2021

03/22/2021

Repaying Deferred Payroll Taxes

IRS Notice 2020-65 allowed employers to defer withholding and payment of the employee’s Social Security taxes. This deferral applied to...

Read More 03/22/2021

03/22/2021

Rethinking Your Employee Benefits Strategy

In the past, as long as you provided health insurance and retirement benefits, your benefits were considered competitive. Now, the pressure...

Read More 03/22/2021

03/22/2021

Hiring in a New Era

As you create your company’s hiring plan for a post-pandemic world, you need to adapt to a new reality. To begin with, you will need...

Read More 03/22/2021

03/22/2021

7 Key Aspects of Payroll Compliance

1. Federal wage and hour laws The Fair Labor Standards Act (FLSA) sets federal wage and hour standards, which are administered by the U.S....

Read More 03/03/2021

03/03/2021

Employment Records Retention: What Are the Federal Laws?

How long do you have to keep records? There’s no one answer. However, we’ve summarized some of the most common federal laws...

Read More 03/03/2021

03/03/2021

Common Overtime Mistakes To Avoid

There are many ways to run afoul of overtime laws. Below are some of the most common — review them to ensure that you’re always in...

Read More 03/03/2021

03/03/2021

Can Employers Mandate Vaccinations?

Can an employer require its employees to get vaccinated against COVID-19? It’s a simple question, but one that does not have an easy...

Read More 02/02/2021

02/02/2021

An Overview of Federal and State Overtime (OT) Exemption Laws

On Sept. 24, 2019, the U.S. Department of Labor issued a final rule increasing the salary threshold for executive, administrative, and...

Read More 02/02/2021

02/02/2021

Are Your Employees Cross-Trained?

When employees quit or miss work for some reason, when layoffs become necessary, or even when it’s just a matter of busy season,...

Read More 02/02/2021

02/02/2021

What Are Predictive Scheduling Laws?

At times, you may want to suddenly change an hourly employee’s work schedule to better suit your business needs. However, several...

Read More 02/02/2021

02/02/2021

Employee Retention Tax Credit Gets a Boost

The second relief bill, passed at the end of 2020, contains updates to the employee retention credit, a refundable payroll tax credit. Each...

Read More 01/14/2021

01/14/2021

5 Time Sensitive Projects Medical Practices Can’t Ignore in 2021

Medical practices should prioritize these 5 time-sensitive projects for the first quarter of 2021. Ever-changing government regulations,...

Read More 12/08/2020

12/08/2020

UnitedHealthcare Telehealth and Telemedicine Policy Modifications Effective 1/1/2021

In the latest Provider Newsletter, UnitedHealthcare (UHC) revealed their revised telehealth reimbursement policies for 2021. Among the...

Read More 12/02/2020

12/02/2020

IRS Updates Form 941 To Reflect COVID-19 Tax Credits

The IRS has revised Form 941, Employer’s Quarterly Federal Tax Return, to accommodate COVID-19-related employment tax credits granted...

Read More 12/02/2020

12/02/2020

What the Taxpayer First Act Means for Employers

According to the IRS’ website, the Taxpayer First Act of 2019 “aims to broadly redesign” the IRS by expanding and...

Read More 12/02/2020

12/02/2020

Cash Balance Plans: Defined-Benefit with a Twist

Both individuals and the companies they work for continue to explore new ways to address the finances of retirement. One option is the cash...

Read More 11/25/2020

11/25/2020

CMS Physician Fee Schedule and RVU Value Changes for 2021 – 7 Areas to Consider

The Centers for Medicare and Medicaid Services (CMS) released its proposed rule for the 2021 Medicare Physician Fee Schedule (PFS) in...

Read More 10/07/2020

10/07/2020

Medicare AAPP Recoupment Terms Finalized

A sigh of relief can be heard amongst the medical community last week. Lawmakers granted an extension for providers who had their...

Read More 09/18/2020

09/18/2020

Medicare Accelerated Payment Program’s Recoupment Paused for DC and Maryland Providers

Backround The Centers for Medicare and Medicaid’s (CMS) Accelerated Medicare Payment program provided advance payments to a significant...

Read More 09/08/2020

09/08/2020

New CPT Code 99072 Usage and Coverage

Early this month, the American Medical Association (AMA) published an update to the Current Procedural Terminology (CPT) code set. ...

Read More 04/14/2020

04/14/2020

HHS Stimulus Deposits To Physician Practices

On Friday, April 10th medical practices started to notice large deposits appearing in their business checking accounts labeled “HHS...

Read More