IRS Notice 2020-65 allowed employers to defer withholding and payment of the employee’s Social Security taxes. This deferral applied to those with less than $4,000 in wages every two weeks, or an equivalent amount for other pay periods. It was optional for most employers, although mandatory for federal employees and military service members.

It’s time to pay back those deferrals.

Repayment of the employee’s portion of the deferral started Jan. 1, 2021 and will continue through Dec. 31, 2021. (Payments made by Jan 3, 2022, will be timely because Dec. 31, 2021, is a holiday.) The employer should send repayments to the IRS as they collect them. If the employer does not repay the deferred portion on time, penalties and interest will apply to any unpaid balance.

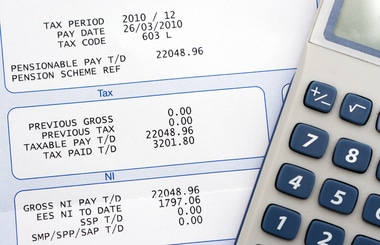

Employees should see their deferred taxes in the withholdings from their pay. They can check with their organization’s payroll office for details on the collection schedule.

How to repay the deferred taxes

Employers can make the deferral payments through the Electronic Federal Tax Payment System or by credit or debit card, money order or with a check. These payments must be separate from other tax payments to ensure they applied to the deferred payroll tax balance. IRS systems won’t recognize the payment if it is with other tax payments or sent as a deposit, according to government instructions. The IRS says that EFTPS will soon have a new option to “select deferral payment.” The employer selects deferral payment and then changes the date to the applicable tax period for the payment.

This is where it can get difficult for employers: If the employee no longer works for the organization, the employer is responsible for repayment of the entire deferred amount, according to the IRS. “The employer must collect the employee’s portion using their own recovery methods,” says the IRS. Further details are available in Notice 2021-11. If you have questions, you should contact a qualified tax professional.

©2021